Personal Banking

The State Bank of Downs offers a range of personal banking options.

So whether you need a standard checking account or are looking to build your nest egg, we've got a solution that can help you achieve your goals.

Personal Checking

Our new personal B-Checking account with paperless statements offers all of the flexibility and great technology with no monthly service charge.

Our platform is highly secure and allows you to manage your money, deposit checks, pay bills, and check on your balance – all from whatever device is most convenient for you.

Free VISA debit card

Free VISA debit card

Access to a nationwide network of MoneyPass® ATMs

Access to a nationwide network of MoneyPass® ATMs

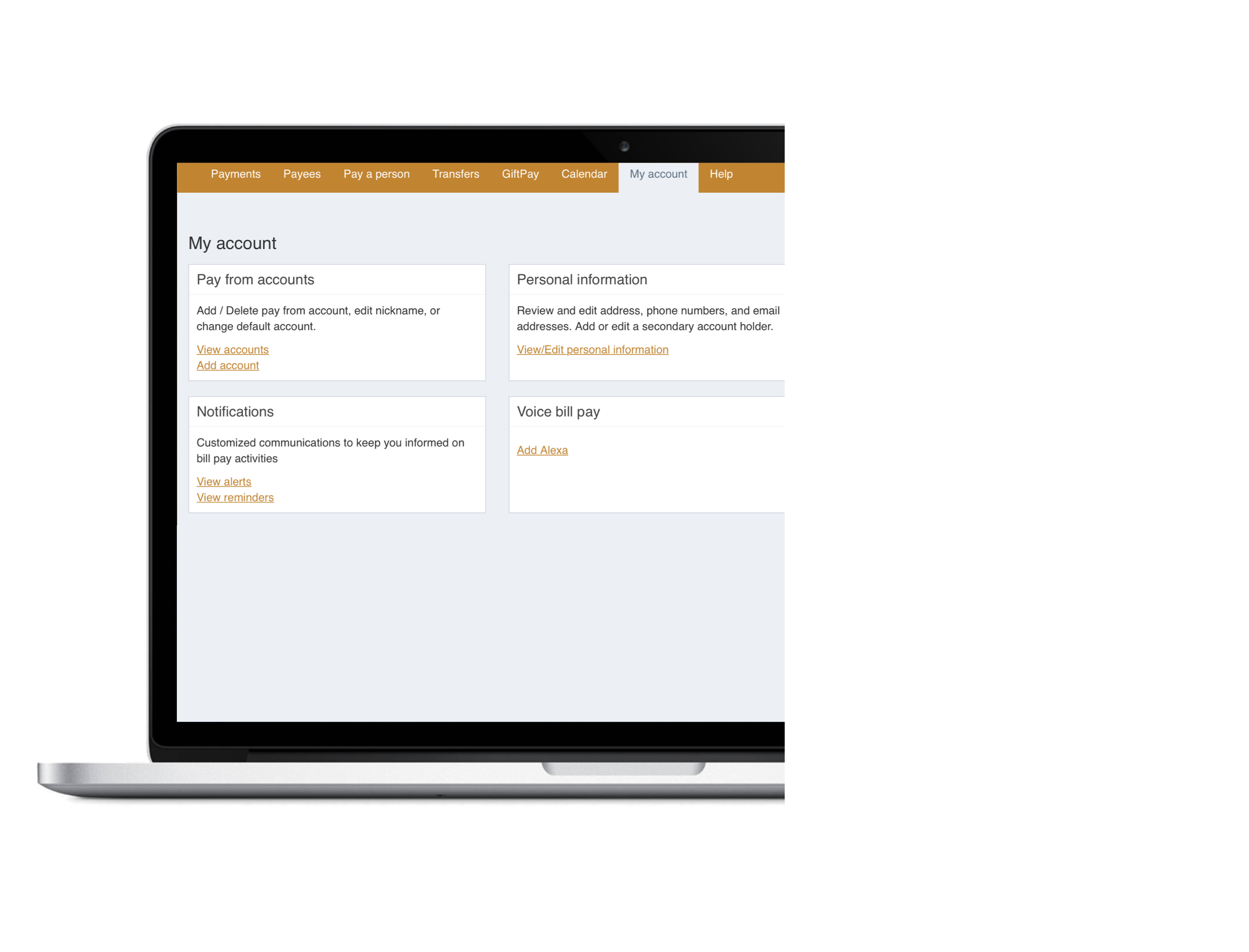

Online and mobile banking

Online and mobile banking

Online and mobile bill pay including pay-a-person features

Online and mobile bill pay including pay-a-person features

Ability to sync to Quicken, Quickbooks and other personal accounting systems

Ability to sync to Quicken, Quickbooks and other personal accounting systems

*$25 minimum opening deposit

Personal Savings

Our goal is to make saving easy. We offer you a range of products that help you save on your timeline and budget, not ours. The State Bank of Downs' traditional savings account provides a flexible, easy-to-use option for those looking to have a little extra stored away. Regardless of what you're saving for, our focus is on helping you meet your savings goals.

*$25 minimum opening deposit, interest is compounded quarterly, interest is paid quarterly, minimum balance to avoid a service charge is $25, also applicable (IRA) savings account

Money Market

Many of our personal customers want the reliable returns and daily access a money market account offers. These accounts earn interest with limited transactions per month.

*$25 minimum opening deposit, interest is compounded monthly, interest is paid monthly, minimum balance to avoid a service charge is $2,000.00

Certificates of Deposit

State Bank of Downs' CDs are an ideal tool for individuals looking for an easy, stress-free way grow their money. We offer competitive rate CDs aimed at helping you grow savings for future needs. Our CDs are as flexible as you need them to be.

*$500 minimum opening deposit, certificates of deposits are automatically renewable or single maturity, interest is paid semi-annually for a term of 12 months or more, a penalty may be imposed for early withdrawal, also applicable (IRA) Certificates of Deposit

IRAs

We know the sooner you start saving, the sooner your retirement dreams become a reality, which is why State Bank of Downs offers customers additional savings tools in the form of individual retirement accounts, or IRAs.